2024′ Top Casinos on the internet to play A real income Games inside United states of america

25 octubre, 202410 Greatest Real cash Online slots Websites from 2024

25 octubre, 2024- David Jeffrey Typed:

Having fun with family collateral finance for repair methods has a bunch away from professionals payday loan Riverview. Can you plan on selling your home in the future or Is your family relations increasing from your own most recent house? Then you can has considered getting a property equity financing for many repair strategies. Among the best methods to obtaining financing for your family renovation is through acquiring property equity mortgage.

On this page, we’re going to talk about the great things about taking out fully domestic equity finance to possess your home renovations assuming simple fact is that best answer to you.

Using Household Guarantee Loan having Domestic Renovations

Taking right out a property collateral loan in the Canada so you’re able to that have family home improvements enjoys experts. First, it is a smart money especially when your intention should be to upgrade and sell your house. Understand that renovated residential property will sell well on the market.

That have a home guarantee loan, you could potentially funds big repair projects also. And additionally, you get foreseeable repaired monthly installments that is a bonus so you can funds in the future. It’s an excellent return on investment as it escalates the really worth of your home. In the event that you sell subsequently, you would certainly be in a position to recover the cash spent getting renovation following alot more.

In addition to, household equity money has straight down interest levels as compared to making use of your credit card or taking out fully a personal bank loan. You are able to use a bigger amount of money also, as compared to amount you will get that have a consumer loan.

Improving your home Equity Loan

You should benefit from your residence security loan. Below are a few tips that can help:

Before applying for a financial loan, regulate how far your house restoration enterprise will set you back. As much as possible, talk to an expert to determine what material is actually expected as well as how much it could ask you for to fund the latest whole investment. Get estimates and you can speak about everything you with your contractor and that means you try capable dictate a sensible funds. Together with, thought including in the fifteen% on estimate, incase you want more money accomplish the home restoration.

When performing house home improvements, it’s always best to work with an experienced builder to be certain your efforts are achieved well. Remember that an excellent home improvements increases the worth of your house. Take advantage of this chance so you can apply for an alternate financial later on and your house will have a greater worth.

When applying for your home guarantee mortgage, it is vital to work with a mortgage broker you never know regarding the and you may who will offer the best provide. That’s where we can come into to suggest your when you look at the the right guidelines. We out-of benefits within Give Today can help you receive a knowledgeable conditions for your home collateral mortgage. We could also get approvals punctual for finding come working on your residence renovation enterprise.

Are a home Collateral Mortgage the best solution?

There are many an approach to financing your house restoration plans. Listed here are the options to keep your remodeling project up-and powering.

Covered Line of credit Using this type of particular credit, you have access to restoration money any time. That is similar to personal lines of credit however it is protected by your domestic security. You to advantageous asset of this is you can aquire a loan that have low-rates of interest. After you work on us, you’ve got the solution to accessibility up to 80% of collateral for your home home improvements. Need not care and attention for those who have bad credit or a lender refused the application. With the direction, we could make it easier to get a home security loan to suit your house renovations.

Second Home loan Which alternative allows you to have the financing out of your home’s equity. With a second mortgage, your home could be the security. The lender will provide you with a lump sum of cash to help you help you complete your residence renovations. The good thing about the second home loan is that you may spread the latest money over extended symptoms and also the interest rates is actually down versus credit card repayments. Work with us to obtain as much as 80% of your house guarantee for usage having home improvements.

The Discounts Otherwise want to bear any loans, another option is to spend less for your home home improvements. If you don’t currently have sufficient finance protected, it may take a bit about how to secure the financing. Additionally, it relies on how large assembling your project is actually.

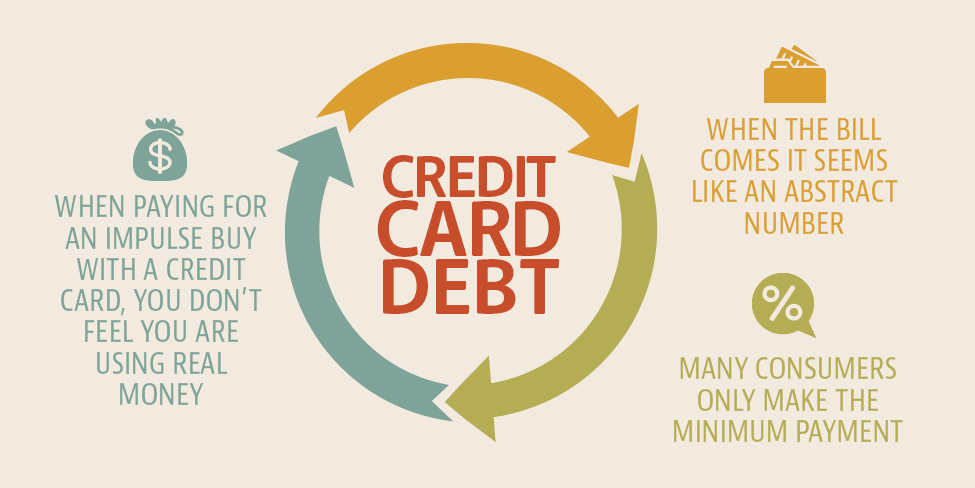

Mastercard Another way is through buying every material needed utilizing your mastercard. Be careful on the with this specific regardless if because playing cards have undetectable costs particularly if you are not able to result in the monthly money. In the event that you to make use of a credit card for your home recovery, make sure that you pay-all their fees timely. If you don’t, your credit rating will be influenced.

Home improvements by using the collateral in your home

Household Collateral Financing This is a good choice for your home renovations. With your let, we are able to allow you to see around 80 % of one’s home security to be used having renovations. Don’t be concerned while refuted because of the financial institutions; you will find hitched with several private lenders that will help you financing your home home improvements.

Heloc This performs much like a basic credit line. You can access around 80% of your house security. One to advantage regarding providing HELOC can it be allows you to 100 % free right up numerous security for your home renovations.

If you have a more impressive renovation endeavor, consider making an application for a property guarantee financing discover bigger fund accomplish your house recovery. Understand that unsecured loans and you may playing cards provides high rates of interest so you could keep away from them. Correspond with all of us so we can present you with a knowledgeable service for your needs.

Get in touch with Provide Today

Will you be probably upgrade your house during the Canada? Please feel free to get hold of all of us so we can help you with your household collateral financing. Our team tend to be than just willing to know your financial problem, inform your towards processes and give you the best solutions to work for you. Use Now or Gives us a trip today at 1-855-242-7732.