Más grandes Casinos Con manga larga Bonos De Giros Gratuito sobre México 2024

31 enero, 2025400% Local casino Incentive to the Very first Deposit To Allege inside 2025

31 enero, 2025Whenever thinking about buying your earliest family, you should will grips having exactly how mortgage dumps functions, including simply how much you will have to help save while the statutes as much as talented places.

Mortgage loans are usually offered by around 95% loan-to-worth (LTV) , definition it’s possible to log in to the home ladder having an excellent put of five% of your price and you may home financing covering the leftover 95%.

How much how about to save?

So you can assess how much you might need to save to suit your financial put, there are two main issues should consider: normal property pricing and monthly installment can cost you.

Possessions costs close by

You can buy a rough idea of regional house pricing regarding assets portals instance Rightmove and you will Zoopla, by speaking to local auctions.

The new rates you’ll see on the sites and you may representative websites is actually asking cost, so they really would-be a little higher than precisely what the characteristics are extremely worthy of.

For lots more real pointers, you should check just how much residential property in the area enjoys sold for making use of the House Registry’s rate repaid device

How much you can afford during the money

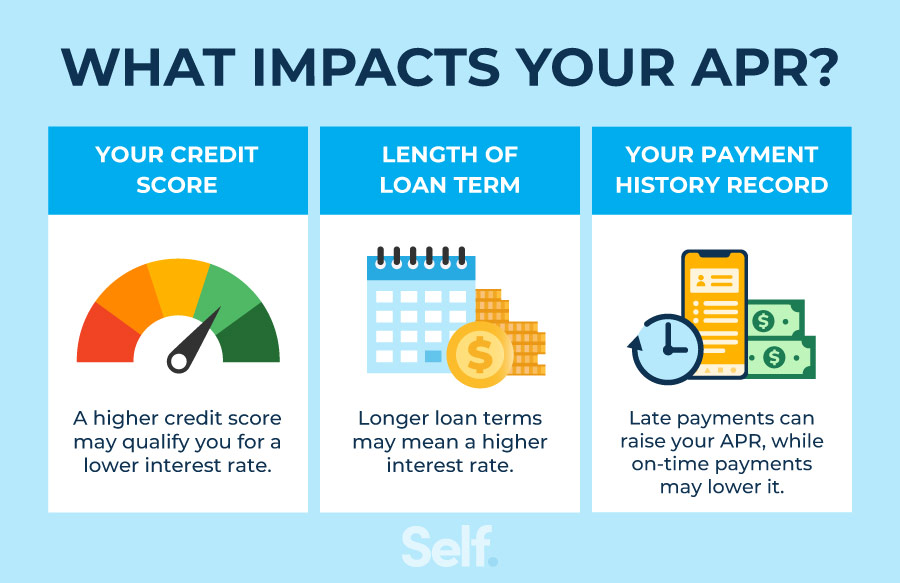

With every monthly homeloan payment, you will have to shell out desire as well as a few of the financing alone. The larger new put, the smaller the loan while the less attention it is possible to shell out.

On top of the rates, you’ll need to consider issues particularly home loan costs, early fees costs, as well as how decades we wish to pay back the mortgage over (the borrowed funds name). All this is said in our self-help guide to choosing the best financial sales .

Whether your repayments to possess a reduced-put financial are too high to you, it is possible to often need to cut a much bigger put or look into choice, for example guarantor mortgage loans .

- Learn more:the expense of purchasing a home

The new table less than reveals the typical size of an initial-date buyer deposit during the all the UK’s countries. Its based on studies regarding Halifax, put out in .

Reasons why you should save yourself a much bigger home loan deposit

However manage to get property with a beneficial deposit of five%, there are many reasons to save your self even more if you can:

- Lower month-to-month costs: this may sound noticeable, however the larger your financial put, small your loan will be in addition to decreased the month-to-month money.

- Finest mortgage sales: a larger put will make you safer having mortgage brokers and you can, thus, they’ll essentially offer straight down interest levels. Including, once we featured from inside the , 90% mortgages were fundamentally around 0.step 3 so you’re able to 0.cuatro fee affairs cheaper than 95% product sales.

- Enhanced threat of getting acknowledged: every lenders carry out cost checks to sort out if or not you might afford the home loan repayments, considering your income and outgoings. For people who simply lay out a tiny put, it’s likely to be you’ll fail these types of checks since you’ll need to spend regarding your own financial monthly.

- Large purchasing budget: loan providers usually promote financing all the way to five-and-a-half of times your yearly salary, therefore if your own salary is relatively reduced and you cannot obtain adequate, you may want a bigger put.

- Safer: for folks who individual more of your residence downright, you’re less likely to end up in bad collateral , where you owe much more about their financial than simply your property is well worth. In negative guarantee renders moving house otherwise switching home loan hard.

Financial deposit calculator

Rescuing to own in initial deposit can seem to be particularly a never ever-end trip. We authored a deposit calculator to give you a sense of when you have conserved enough to purchase a house on your own area.