Greatest 15 no deposit bingo websites in the usa gambling establishment Cat Bingo Oct 2024

7 noviembre, 2024Ladbrokes Local casino, Bingo, Slots and you may Web based poker Remark 100 percent free Spins Incentive Code

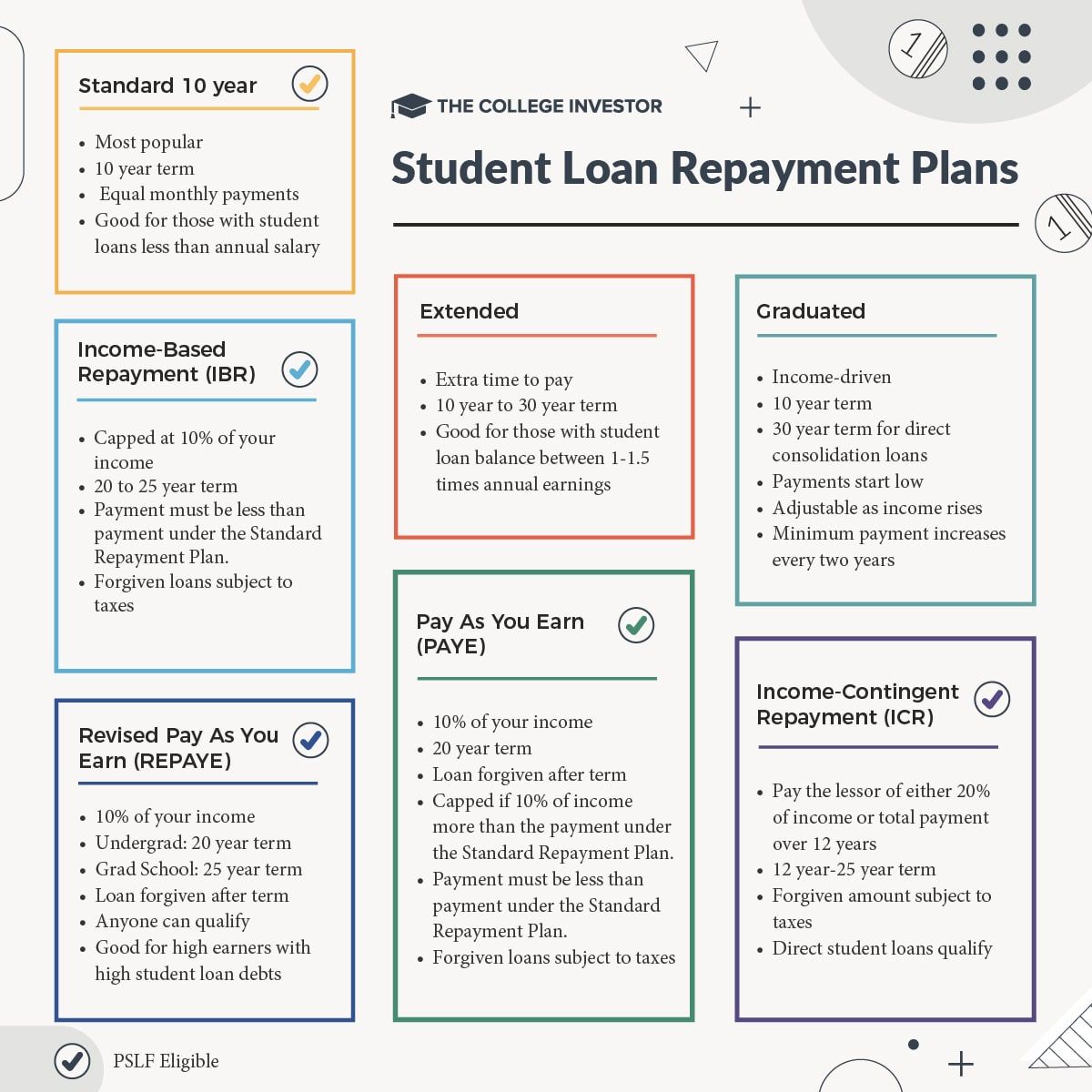

7 noviembre, 2024A debt-to-Money ratio (DTI) suggests the method that you take control of your introduce and you may earlier in the day expenses together with your monthly income. Thus, loan providers assume one maintain this ratio so you’re able to less than otherwise equivalent to 50%.

Reference to the lending company

Lenders commonly trust your when you’re currently a preexisting buyers with a good credit score. And since the lender has already been conscious of debt trustworthiness, they will present a quick financing without having any data

Understand the goal when deciding to take financing: You will find a definite thought of the loan finances and installment feature once you understand the goal. Furthermore, you could plan an actual funds according to the notice you happen to be purchasing.

Bundle your finances: Before applying for a loan, browse additional credit organizations and you may assess brand new EMI having payment regarding websites available on the internet. Such as this, you can examine the attention cost banking institutions offer while making an effective obvious choice.

Pay on time: When you are getting the borrowed funds amount, make certain you afford the EMI on time every month. Because if your overlook people payments otherwise make any late payments, your credit rating might possibly be inspired negatively.

Use your loan to possess debt consolidation: For those who have one outstanding costs to get paid back, you could sign up for a consumer loan and employ the quantity to repay your early in the day bills. You’ll repay multiple debts playing with a single loan amount.

Problems To stop While you are Obtaining An unsecured loan

Signing the loan arrangement without studying the brand new Conditions and terms carefully: It is essential to look at the Terms & Standards before you sign the loan contract to stop getting involved in any too many problems.

Maybe not figuring your EMI beforehand: Before applying for a loan, generate a clear budget on your loan amount and calculate your own EMI. This helps your evaluate and choose an educated interest rates.

Submission multiple loan applications: After you submit an application for a loan out-of several loan providers at the same time, per lender conducts a credit assessment to test your credit rating. Thus, an arduous inquiry is established and you may mirrored on the credit history, which ultimately has an effect on the financing get.

Bringing financing more called for: Plan the amount of mortgage you require the most before applying for the loan and avoid bringing more requisite. By using over requisite, you can get left behind otherwise make late costs. This is why, it will subsequent affect their credibility.

Not obvious about your goal: Discover the reasons why you need certainly to borrow funds so you can package the loan budget according to your repayment element.

Keep this in mind Before applying To have An unsecured loan

- Credit history: Lenders anticipate you to definitely has a credit rating a lot more than 750 as they means that you can pay the loan on time. More over, look at your credit report continuously to track your financial standing. You’ll be able to look at the rating using Pal Score and also a full credit report quickly.

- Qualifications Requirements: Verify that your meet up with the expected qualifications requirements of financial or loan company you are obtaining.

- Documents: Fill in every mandatory data online payday loans Illinois for verification, eg Aadhar Card, Dish Card, Passport and you may Lender comments.

- EMI: Estimate the fresh new EMI you have got to repay ahead of time in order to bundle finest.

- Submit the application which have real personal and you will elite information to own get across-confirmation.

Summing up

Signature loans is a lifestyle-saver when you need instantaneous funds. And regularly, even although you lack earnings research, you could nonetheless acquire the loan using the suggests said a lot more than. Moreover, possible score a personal bank loan using Pal Mortgage and you can get your amount borrowed contained in this a few hours. You’ll be able to check your credit history using Buddy Rating to understand their creditworthiness.