Idræt Medmindre Nemid Plu Mitid Pr. Spiludbyderne

4 septiembre, 2024Spilleban eksklusiv NemID Udenlandske casinoer eksklusiv NemID

4 septiembre, 2024Guides

If you’re in the market to buy assets, it is likely that make an effort to acquire to fund they. Since it is, to acquire yet another residence is currently tiring rather than knowing if the you get recognized for a financial loan just increases the anxiety. Listed here are 8 basic steps to maximize the probability:

The way to do that is by doing brand new talk early with your potential lender. Typically, their financial will enquire about the possessions, monthly income, debts, and you will estimated advance payment. The secret is to put oneself regarding the position out-of lenders and evaluate the around three things it consider whenever determining financial applications: your income, your credit score, and your loans service proportion (or perhaps the portion of your own monthly grab-domestic spend which can got to your own monthly amortization).

Some individuals never ever comment its credit score before submission a property loan application and just assume that previous non-costs try forgotten. If the low-percentage was out of various other lender or even the bank your location trying to get financing, so it expectation is actually an error. Finance companies and other lenders usually express information about outstanding (non-paying) individuals and you may reputation for non-fee is a big red flag getting loan providers.

Economic Web log

Cleanup your credit report if you are paying debts timely, getting rid of credit card stability, and, when you have outstanding money, pay them from and have a certification away from fee on lending institution. Be sure to not ruin their borrowing in loan running since the diligent lenders both check your credit history the second time for you find out if some thing has evolved.

Lenders end high-risk subscribers therefore place your better ft submit because of the becoming economically secure. Just be sure to take care of a constant cash flow and avoid brand new financial obligation. Adhering to your employer whenever you are going through the property procedure is essential. In addition, taking a diminished-investing occupations or stopping becoming worry about-working is a red flag getting loan providers that will delay otherwise stop your app entirely.

Although you don’t need a no equilibrium on the credit cards in order to be eligible for a housing mortgage, the new smaller you borrowed creditors, the higher. Usually, avoid one significant instructions-eg financing an alternative automobile, co-finalizing various other loan, otherwise happening a costly travels making use of your bank cardup to once you’ve secured the loan.

Mortgage calculators are good products to evaluate in the event your funds is also most manage the newest commission program. They are able to assist you just how much the month-to-month mortgage repayment create getting below another house rate, interest, loan period, and you may annual income issues.

Play with calculators and you will familiarize yourself with the financing to determine everything you may actually purchase prior to bidding on services. It’s hard to-fall crazy about a good fantasy house’ which you can’t afford. Dealing with this step could save you loads of psychological and you can monetary fret shifting.

Strolling into the a great lender’s office that have no cash is a quick answer to flush the loan software along the drain. Apart from boosting your borrowing from the bank updates, a massive checking account can help you pay back an option of cash costs. Remember, loan providers are careful. If you are planning to apply for a home loan from the near future, expect you’ll coughing right up some cash to have down repayments.

An average of, you’ll need at least 20% of your home price having down money however is always to point to have a top deposit to lessen your complete home loan equilibrium. Keep in mind that downpayments are not the only cash costs you really need to love. Getting a home loan plus relates to domestic appraisals, term recoveries and other expenditures in the handling of your mortgage.

No lending company usually takes your towards given that a customers until you can show who you really are. Make certain you have americash loans Anderson an up-to-big date ID and therefore new address to the all of your current IDs is best.

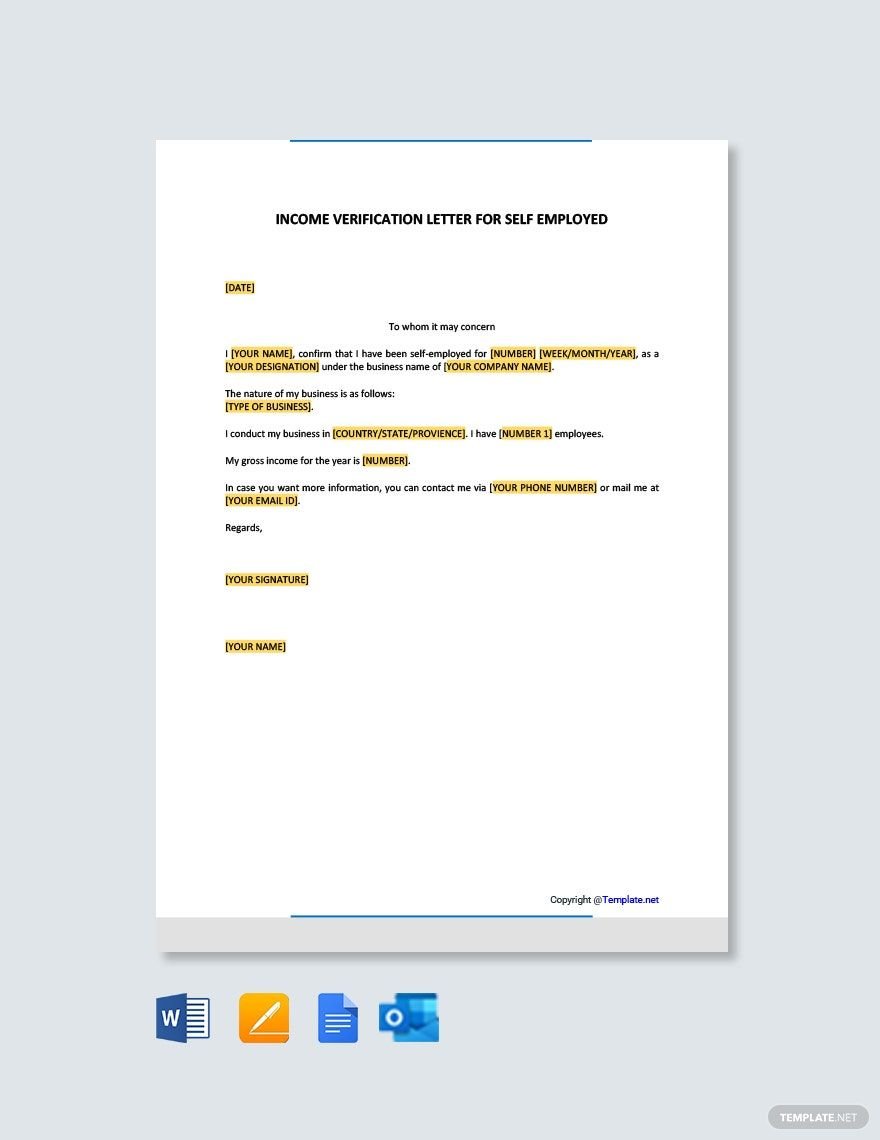

Try to offer your lender with plenty of financial documents thus ensure that you assemble her or him prior to beginning the application. At minimum, you need a legitimate (photo-bearing authorities approved) ID, proof money (a career certification, ITR, or payslips), or other relevant security files. You may need to promote extra proof of your income in the event the you may be self-functioning.

After submission the application, you should open your own communications contours to be able to respond to any asks for info out of your financial. Waiting too much time to react can cause a put-off when you look at the running the loan, otherwise tough, inflatable the application entirely. Immediately after covering your entire angles up until now, it is better not to ever set yourself in a position to bungle the application-losing your dream household including one put you may want to have put down.