Free Ports No Install Enjoy a hot shot progressive slot thousand+ Which have Bonus Cycles

23 septiembre, 2024What you should do Unless you Borrowing Be eligible for Georgia Fantasy

23 septiembre, 2024We know you want home financing to order a different home otherwise re-finance a current you to definitely, but the majority people do not put plenty of consider to the financing administrator it like. This could also be the first occasion you’ve got heard about a loan administrator.

Such every other industry, loan officials has certain experience. There are various mortgages available to choose from and other borrowers with assorted financial demands, so deciding on the best financing manager to match you on the right financial is necessary as soon as you start our home-to shop for procedure.

Exactly what Qualities Do you want into the a loan Administrator?

A loan officer works best for a financial otherwise home loan company so you’re able to let homeowners make an application for a loan immediately following an evaluation of the financial situation . There’s no that-size-fits-most of the approach to getting a home loan. That’s why we have loan officers who will select the most useful sorts of financing for the requires, demands, and you may life.

Experience with industry

Like most most other jobs, your loan officer’s feel usually mean the level of skill. When searching for an officer, don’t hesitate to find out about the experience. Its also wise to consider their providers, since the more home loan enterprises can offer additional financial sizes.

You can also imagine obtaining the financing officer’s All over the country Multistate Certification Program (NMLS) count and seeking it up to discover one problems produced up against them .

Knowledge of Various types of Mortgages

To the quantity of mortgage loans readily available, we would like to ensure that your loan administrator practical knowledge which have the type of loan you want, like conforming , government , jumbo , or refinancing fund.

If you aren’t sure exactly what type of financing best suits you, the mortgage administrator have to have sense working with individuals from inside the comparable monetary affairs.

Timely Handling Go out

Taking financial recognition punctually will likely be a major cause of whether you order property in advance of most other curious people. Control date cannot generally fall on mortgage manager, but alternatively towards the sort of loan. Like, good jumbo loan needs the next underwriter, definition the latest operating go out is sometimes more 30 days. Definitely pose a question to your financing officer initial in the processing times each mortgage.

Fluent Financial Review

Debt documentation is considered the most essential piece of pointers whenever getting acceptance for a loan. Your loan administrator need safely consider the income tax get back and other needed papers. One minor problems could cause the latest assertion regarding that loan.

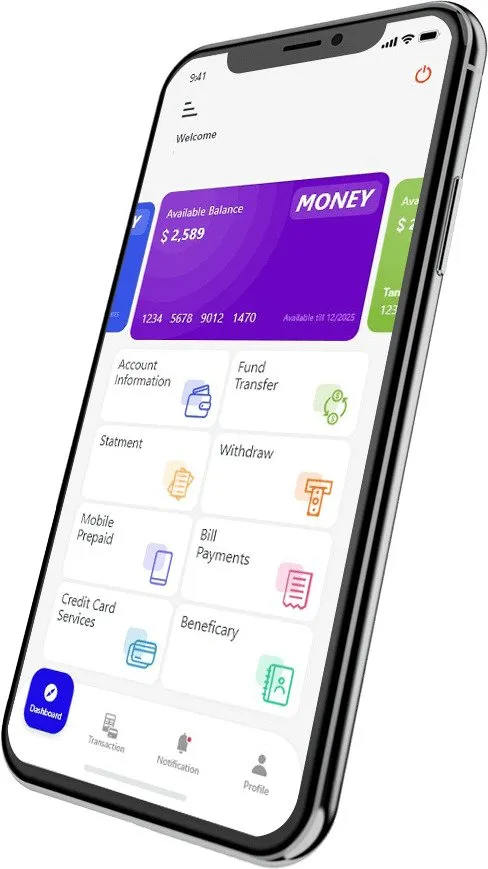

Tech Experience in Automation Softwares

Progressive mortgage officials should be experts that have state-of-the-art software you to improve the method, particularly mortgage origination possibilities. This allows them to purchase more hours to meet your targets.

Good Support service and you can Correspondence Event

Loan officers don’t simply work on website subscribers-nevertheless they manage realtors, developers, term organizations, appraisal companies, and handling, underwriting, and you will closure departments, so they really need expert customer support and communications skills.

What are that loan Administrator

Though it isn’t really wanted to partner that have a neighbor hood lender, there are many different masters into the partnering that have anyone who has a great solid put of homes:

A customized Feel

Being able to satisfy in person together with your loan manager also have support that they’re coming soon. Along with, if your financial is situated in their urban area, you have a much better opportunity away from hearing about somebody’s experience working with these people personal.

Regional Options

An additional benefit at your workplace that have a local mortgage officer is their awareness of local markets conditions. A location bank knows about new demographics and you can history of the newest town, in addition to financial trend that will make it easier to get financing as compared to a national lender.

Good Dating that have Real estate agents

Their agent and your financing administrator collaborate in order to support you in finding suitable family. If you find ideal home with the agent, might next talk to your loan administrator locate acceptance easily.

Pick that loan Officer during the radius

You prefer a loan manager having good correspondence and you may customer service feel, tech assistance, and you will regional feeling, and discover that in the distance. distance was a consumer-obsessed lender that have Loan Officers who’ll suits your into most readily useful mortgage for the state.