10 Best Crypto Local casino Betting, Playing United states Sites of 2024

29 octubre, 2024They could be sure to fool around with a proper-reliable company for your house review

29 octubre, 2024Credit score Formula from the Experian – Procedure.

Including the most other credit agencies in the country, Experian has a lot of creditors which can be its people. These institutions also have NBFCs also banks while they fill out the credit investigation of borrowers to help you Experian. A few of these articles began within the guidelines off Set-aside Financial of India off Credit advice businesses control work 2005.

Experian spends every piece of information by making their borrowing recommendations statement. There is a large number of the key parts of the credit history data and you will a formula that make their 3-digit credit score between three hundred and you can 850..

Today ,you have the notion of the credit overseeing techniques from inside the experian, allows recognize how borrowing from the bank keeping track of are processed away from Experian and you can Transunion

Do you know the benefits associated with that have a good credit score?

The second professionals are just accessible to people who take care of an see it here effective clean and uniform fee records while having a high credit history.

You’ll located that loan within Reduced-rates of interest.

That have a great credit history can be extremely advantageous for you. It makes you be eligible for funds which have a minimal-interest. And therefore it will make they more straightforward to pay back your debt rather than any issue. You need to hear this simply because even a half percent boost in the speed could affect your money.

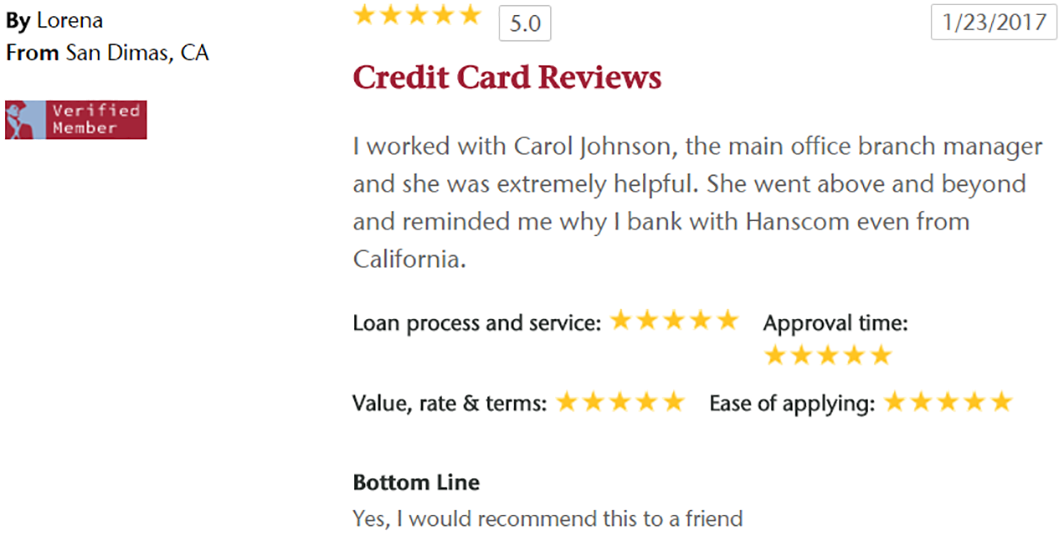

You should buy quick recognition having credit cards and mortgage.

When you yourself have a premier credit history, it will demonstrate to lenders their creditworthiness, that leads these to give you quick mortgage recognition. Which, individuals with excellent fico scores will benefit throughout the quick greet out-of funds and handmade cards. This is very important when you yourself have any emergency and require a funds quickly.

In addition, loan providers, banking institutions, and loan providers deny the new consumers with poor credit feedback due to the fact of its unreliable borrowing records. You need to remember that individuals other factors may also be sensed after you sign up for financing otherwise pick a credit card.

You can have best deals fuel towards the lender

A beneficial credit rating will provide you with the power to negotiate towards the lower rates of interest or to your a more big amount borrowed from the lenders. Hence, a good credit score can raise new negotiating electricity of individuals. Apart from all this, it does also entitle the latest debtor locate unique savings, income, and will be offering.

You may have a good chance of getting a leading limit with the the new finance.

An individual’s credit history and you will income are utilized of the lending associations and finance companies to decide how much cash they can borrow. Financial and you can creditors will make you good an effective mortgage in the event your credit rating is high. Their large credit rating allows you to an effective borrower. Yet not, in the event the debtor have a minimal credit rating and you can desires a mortgage. The loan would-be recognized, nevertheless bank often charges higher interest rates.

You could potentially easily rating a high restrict on the mastercard.

Credit associations and you can banking institutions have fun with an individual’s credit history and you can income to decide simply how much they are able to obtain. You can buy the best interest levels, perks, sale, discounts, and you may cashback also offers from all of these notes. Make sure you pay off your own credit cards and you can fund for the date when you are considering to find one thing over the top with several perks.

You can purchase the potential for providing an extended tenure.

Good credit often leads you to definitely a higher opportunity of going a longer tenure on your loan. A longer period reduces your month-to-month Emis, that will help you keep your cash securely.