In fact he is needed for particular regulators-backed loan apps

3 octubre, 2024Tax Advantageous assets to Home Collateral Fund and you may HELOCs

3 octubre, 2024If you’re contemplating to invest in a property but concerned that you are unable to meet with the minimum down payment requirements, you will find great news. Yes, you’ll find lower down percentage choices versus basic 20%.

While you are a 20 percent downpayment has actually typically come the quality for brand new homebuyers, moments provides changed. Now, mortgage lenders render numerous reduce percentage applications. You’ll find alternatives demanding as little as 5 per cent, 3 percent or even 0 % off, and additionally first-date homebuyer apps you could make the most of. Since the lowest downpayment may vary from the lender and you will mortgage system, let’s glance at the spot where the 20 percent advance payment profile happens regarding.

When you are which have a higher down-payment, you are and additionally reducing the amount of money that you’re borrowing a glaring, however, essential point. This helps to choose the loan-to-worthy of proportion (LTV), which conveys how much cash you are able to owe in your loan once you shell out the deposit. Very, increased down payment output a lowered LTV proportion and you may home loan lenders consider your LTV when approving their home loan app.

So you’re able to teach how the downpayment number could affect the monthly commission, have a look at analogy lower than, and this measures up the minimum advance payment (5 %) on the a traditional mortgage so you can a 20% deposit:

One more reason many people opt for a top down-payment was one individuals which pay lower than 20 percent into the a mortgage down payment are generally necessary to pay for Individual Mortgage Insurance (PMI) near the top of their month-to-month homeloan payment. So you’re able to loan providers, an effective PMI reduces the brand new recognized exposure.. Specific individuals really works for this issue by firmly taking aside a couple of mortgages, the initial one to generally level 80 percent of the home rates for the 2nd you to (known as a piggyback loan) layer 10 percent of the property rate making 10 % getting a down payment and no PMI criteria. Piggyback funds aren’t due to the fact prominent as they were in the past, although, possibly since today’s mortgage field provides too many feasible choices in order to select, intricate lower than.

Option #step 1 FHA Loan

There are numerous bodies-recognized, nonconforming financing geared towards assisting lower income property and you will to make residential property inexpensive, you start with that regarding the Federal Houses Government (FHA). FHA home loan software are ideal for first-day homeowners, while they provide faster off payments and can benefit consumers with down credit scores. In reality, consumers can get a keen FHA mortgage with a deposit given that lower while the 3.5 per cent of your home’s price, depending on the U.S. Service out of Casing and you can Urban Innovation, this new institution you to manages FHA.

Yet not, if you don’t should spend financial insurance rates, bear in mind one to FHA individuals should buy FHA personal home loan insurance coverage right down to not placing 20 percent down. These types of costs usually last for the life span of your mortgage.

In lots of metropolises meaningful link, your neighborhood or federal government now offers deposit recommendations software so you’re able to renew areas struck tough because of the disasters otherwise recessions. In the event they either possess earnings limits, people are often in a position to obtain advice whenever they see in which to appear. Atlanta and you will San francisco are two finest advice, though this type of apps commonly limited by large urban centers. They’re included in towns, areas and you can says all over the country. This means doing your research, calling their municipal housing authority and probably working with home financing broker who can area you regarding proper assistance. But don’t restrict your search so you’re able to topography. Certain employers and you can elite group groups bring deposit guidance applications given that really it never ever hurts to inquire about.

Choice #3 Experienced Circumstances (VA) Financing

Supplied to effective servicemembers and you may veterans (and surviving partners), Virtual assistant funds is actually customized in order to armed forces group and supply completely capital. Not only that, depending on the Department of Seasoned Things, a beneficial Virtual assistant loan may help customers pick otherwise re-finance a home at the a low interest rate, will as opposed to an advance payment. When it comes to Virtual assistant mortgage gurus, individuals get reduced closing costs, appraisal can cost you and you may mortgage origination charge. Along with, consumers won’t need to pay PMI, no matter how much downpayment they shell out, and make Virtual assistant fund a far greater option than simply FHA money within value.

In order to be eligible for an excellent Virtual assistant financing, potential housebuyers need certainly to see certain provider standards and have now good credit rating, sufficient monthly earnings and a certificate regarding Qualifications (COE).

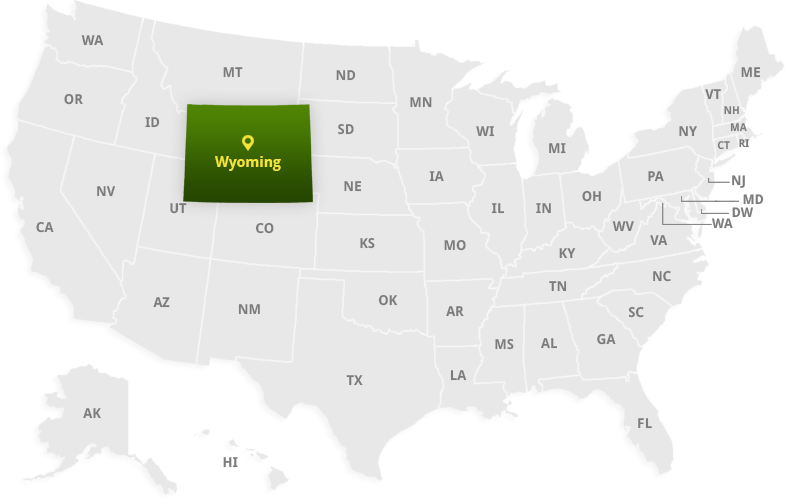

Option #4 USDA Financing

Another financing that provides 100 % investment ‘s the USDA Outlying Casing Financing, covered of the U.S. Service out-of Farming (USDA). Mainly made to prompt homeownership within the rural areas, such financing are also made of cities (although the institution simply approves specific property, definition the choice need to be USDA-qualified) and want zero down-payment. Like Virtual assistant financing, USDA fund are affordable, but in the place of Va funds, they actually do want consumers to invest home loan insurance costs.

Solution #5 Antique 97

The standard 97, provided by Federal national mortgage association and Freddie Mac, only means a great 3 % down-payment. Such mortgage loans normally have quite higher lowest credit history conditions, but antique 97 loans let the borrower so you can terminate PMI shortly after it come to 20% collateral. Another advantage? Individuals can fool around with skilled fund as well as boss otherwise chapel provides for everyone otherwise part of the deposit.

Almost every other factors

Particular lenders offer no-PMI funds, meaning that it (the lender) pay for the loan insurance policies. The fresh financial change-from is you will get a top rate of interest. This can be just as the change-out of that is included with zero deposit fund, and therefore both setting you have to pay even more charge as part of your settlement costs. Listed below are some the self-help guide to home loan rates to see which types of finance and cash down often apply to your own costs.

As you inquire, Should i put 20 percent down on a mortgage? you will need to run the fresh new wide variety into the payment distinction, weighing advantages and you will downsides, following talk to a dependable mortgage creator. They’re able to help you find the best mortgage program that suits your position and see how much to pay on your down payment. Make sure you question them on other requirements, like average income levels, minimum credit rating thresholds, caps about precisely how your primary terrible month-to-month earnings may go so you’re able to property-related expenses and you will obligations-to-earnings ratio (DTI) criteria.

At the AmeriSave, we could look at the qualifications for the certain financing applications and provide you with factual statements about shorter down payment options, in addition to every the second information.