100 casino star spins casino percent free Revolves No deposit NZ Keep the Payouts

13 diciembre, 2024Information Slot machine Volatility: Lower against Highest Volatility Slots

13 diciembre, 2024Your credit rating is among the most many items lenders evaluate whenever contrasting your financial app. A leading credit history can help you qualify for the mortgage and you may rating an educated costs and conditions on the financial.

The financing get needed seriously to buy a property largely depends on the sort of loan you’re obtaining. It is best to know exactly how your credit rating work together with different factors affecting it. This informative article helps you take steps to alter the rating prior to purchasing a home.

Of several lenders wanted a minimum credit rating of around 620 to help you pick a home with a traditional home mortgage. Although not, there are more financing selection which may accept consumers having credit score as little as 500.

Such as for example, FHA funds allow you to be eligible for a home loan which have a cards score as little as five hundred or 580, dependent on your own deposit. For many who qualify for an excellent Va loan, you will possibly not have any credit score conditions, however, usually 580 ‘s the minimal necessary. However, a credit history of 740 or more is best since you to definitely assists you to qualify for an educated costs and you may terms on the home loan.

If you have a leading credit score, you might be less likely to default in your home loan. Since your bank observes you because the less risky, https://simplycashadvance.net/title-loans-ct/ they are ready to offer you down interest rates and higher mortgage terminology. So it is crucial that you know what good credit was and just what loan providers are searching for after they take a look at mortgage programs.

Credit rating Groups: What they Indicate

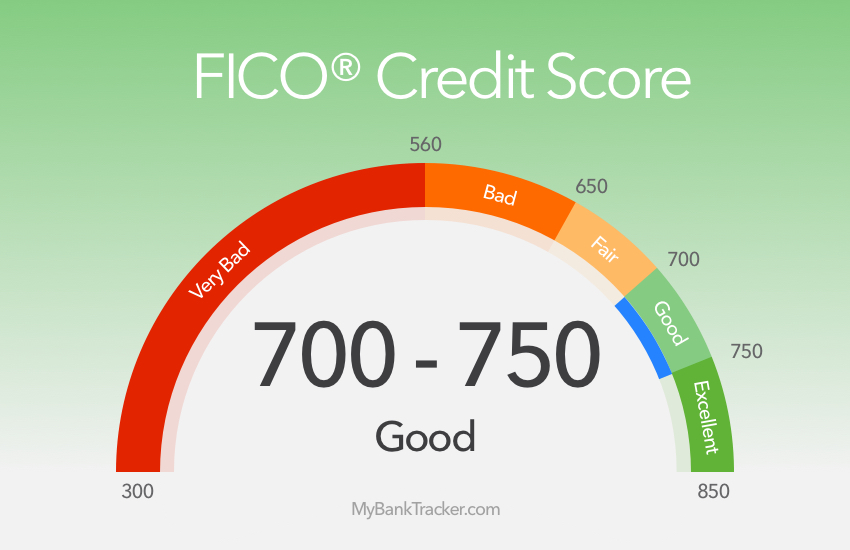

Very credit ratings belong the range of 350 so you’re able to 850, together with higher your own get, the better. Very lenders examine FICO Scores and then make lending conclusion. You’ll find five some other groups you could potentially get into centered on your credit score, each that has an effect on the loan words.

- Exceptional credit history: If the credit history are more than 800, it’s noticed outstanding and implies in order to loan providers that you will be an extremely lower credit risk.

- Decent credit history: Credit scores ranging from 740 and you can 799 are thought very good and you may will help you be eligible for an educated prices and terms and conditions into the the loan.

- Good credit score: If your credit rating is actually anywhere between 670 and you can 739, it’s sensed a get in fact it is nonetheless higher than the brand new average U.S. individual.

- Reasonable credit score: A credit score anywhere between 580 and 669 is regarded as reasonable and you can try below the mediocre score having You.S. consumers. Particular loan providers was ready to assist you, however you will have likely high cost and you will charge on your own financing.

- Bad credit get: People credit score below 580 is considered bad and you may implies you may be a high financing exposure. If you have a woeful credit get, you’ll receive minimum of beneficial loan conditions, and in case a lender is additionally ready to assist you.

What Lenders Look out for in Your credit rating

- Payment history: Their payment ‘s the key lenders consider, and it is the reason thirty-five% of your own credit score. Percentage records reveals whether or not you have to pay their bills timely, and you can suggests exactly how much from a credit chance you are.

- Credit application: Their borrowing utilization is the portion of your own offered borrowing you to you’re currently playing with. It makes up 29% of FICO Rating given that a premier credit application implies you’re financially overextended.

- Duration of credit score: The duration of your credit history is the reason 15% of one’s FICO Rating. Loan providers like to see which you have an extended background out of looking after your credit profile in the a reputation.