Paying off a property Equity Mortgage or Line of credit

15 octubre, 2024eight prospective cues your ex lover actually loyal

15 octubre, 2024A house collateral financing should be an effective unit once you you desire an enormous sum of money. If we need to alter your family, pay back higher-attract debt, or money the infant’s studies, their guarantee enables one borrow cash in the a much lower rates than simply credit notes.

A lot of people opt for an extended repayment label to own a house collateral mortgage to keep payment per month numbers practical. Exactly what if you discover that your month-to-month cashflow features improved? Is it possible you repay it early? As with numerous things, the answer is in the small print.

Key Takeaways

- Domestic collateral fund is secured using the security made in your own number one quarters.

- Family security financing have a standard monthly payment and you can name.

- Partners household equity funds provides an earlier incentives penalty, however, browse the conditions and terms to ensure.

What is a home Equity Mortgage?

A home security mortgage are that loan that’s covered because of the this new security made in much of your quarters. As you make mortgage repayments, your create guarantee, whittling down the harmony towards count which you are obligated to pay.

Equity depends upon subtracting the difference on your own a fantastic mortgage on economy value of your house. You might make security rapidly if you purchased your home whenever the market try much lower. You to definitely equity is then familiar with decide how far money an excellent lender could possibly get allow you to obtain with your domestic because the equity.

Household equity loans are occasionally named 2nd mortgages since they operate really comparable styles. Repayments, interest levels, and you can terminology is actually fixed getting a standard amount of time, generally five so you’re able to 3 decades. And simply instance a primary mortgage, home guarantee funds fees attract. The new extended the fresh repayment name, the more attract you pay over time.

Very important

Before you go and come up with a final fee on the house equity financing, call their financial. Simply they may be able offer the correct latest commission number oriented about how precisely much attract keeps accumulated where fee duration.

Might you Shell out Your home Guarantee Financing Very early?

Just like the a lender produces their profit into the attract billed toward people financing, it’s easy to understand why they’d need to make certain a complete identity is honored. Although not, really household equity money usually do not happen what is known as very early incentives penalties. When they do have an early payoff penalty, it should be manufactured in the new loan places Montezuma contract into financing.

A debtor need certainly to investigate mortgage contract’s conditions and terms to ensure one zero hidden penalty costs or costs come. In the event that legal language is tough to you personally, ask your financial in the event that you’ll find early benefits punishment. Provided there aren’t any explicit says out-of punishment to own very early benefits, you’re able to pay even more on your own financing until it are reduced.

Regarding unusual question of an early on fee penalty, it however will probably be worth settling your residence equity loan early. Based on how decades you might shave from your own deal, it may be worthy of expenses a single-go out punishment to save many in the accumulated focus.

Why Pay Your residence Guarantee Financing Very early?

Now that you’ve found that you might pay off your property collateral loan very early, you may weigh advantages and you may cons. Of many consumers prefer an extended term for their financing so that he’s way more respiration place in their month-to-month budget which have a down payment per month. In case they realize that its earnings expands, expenses so much more with the the principal of the house equity financing normally help save extreme desire costs.

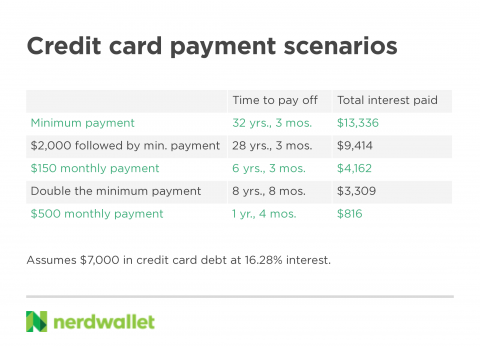

Upfront purchasing most on your own loan, work with the fresh new quantity regarding how far you can save by paying it regarding early. For individuals who borrowed at a low interest, it could be well worth using on your own most recent commission bundle and expenses the cash you’ll purchased to pay off the brand new mortgage faster. If for example the objective is to lose monthly premiums, make payment on mortgage away from very early may be more appealing than might secure in the market.

How do i Pay-off My House Collateral Financing Early?

- Lump sum payment: If you’ve conserved your whole amount borrowed inside a good separate membership, you could repay it in a single fee. You are going to need to call your own bank locate a final benefits amount.

- Most prominent repayments: You can include a certain amount to each and every payment to reduce the amount of prominent that is getting focus.

- Sporadic costs: When you yourself have extra money, you might utilize it for the loan. That is a great way to have fun with bonuses otherwise tax refunds.

What is the minimal matter that i can obtain in an excellent house equity financing?

Unlike a property guarantee credit line (HELOC), that’s good rotating personal line of credit, a house equity loan is actually an appartment contribution with standardized payment agreements. Per bank get its lowest loan amount, but $10,000 is a fairly important count.

Should i borrow a full number of my guarantee?

No. Lenders will only mortgage a portion of your own security, although you have paid off your residence. Really lenders simply allow you to acquire 80% of your security of your property.

What goes on basically default back at my household security financing?

Defaulting on your loan can cause shedding your home. Since you are utilizing your domestic due to the fact equity toward loan, a loan provider metropolises a beneficial lien on your own house. When your loan is not paid, capable foreclose with the home to recover their financial support. In the case of a home equity mortgage, an important mortgage might be repaid first and then the home equity financing.

The conclusion

Paying off your house guarantee financing early is a fantastic ways to store excessively attract along the life of the loan. Early benefits punishment is unusual, nonetheless they do are present. Double-look at the mortgage offer and inquire physically if you have an effective punishment. You may want to have more confidence regarding the signing an extended offer with down repayments if there’s zero penalty getting an earlier rewards.