Unser Tagesordnungspunkt 50 Book Of Darkness Slotspiel Je Echtes Geld Sonnennächster planet Spiele 2024

11 noviembre, 2024Spielbank Freispiele bloß Einzahlung 2024 Religious Freespins beschützen

11 noviembre, 2024American Opportunity Tax Borrowing from the bank (Pledge Borrowing)You

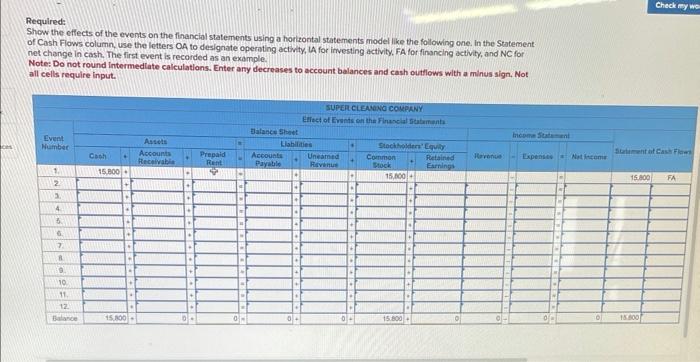

Membership ReceivableAccounts receivable try asset levels you to a pals, corporation, connection or any other company organization has. Speaking of usually small-term account from which company organizations expect repayments from other enterprises, subscribers and users.

) to have revealing earnings or expenses for a company, company, connection and other, business organization. By using the accrual base, earnings and you may/or expenses is said whenever earned, maybe not whenever obtained.

Accrued ExpenseAccrued expense was a price at which a company, company, and other company entity has presumed the obligation to blow, however, have not paid down.

Accrued RevenueAccrued money is the earnings/cash you to definitely a company, organization or other company organization has experienced the fresh promise out of payment of another team, client otherwise consumer, but has never in reality gotten fee.

Gathered DepreciationAccumulated decline is the number adopting the first 12 months, basic 50 % of-seasons otherwise earliest one-fourth of depreciation that a business organization can be deduct regarding earnings so you’re able to recover the cost of a beneficial organization resource over a length (always a decade) where in fact the advantage reduces the really worth.

Active-Fellow member StatusRelating in order to enterprises and financial issues, the newest energetic-fellow member updates means people who individually be involved in the task out-of a buddies, corporation or any other, company organization, otherwise make conclusion for a company, company and other, organization entity.

ActuaryAn actuary was a person who works well with an insurance coverage organization. He/she works out dividends and you can premiums, and may even print and you can publish tax-related statements to people who possess insurance regarding that one team.

Varying Speed MortgageAdjustable Speed Mortgages keeps changeable, interest rates. The eye pricing commonly vary from Kansas loans year to year providing towards the idea the expenses toward financial or other, borrowing from the bank facts.

Adjusted EntryAn entry should be a numerical worthy of or text message on the an expenses, evaluate, charge, discount or other, financial statement. A modification (modified entryway) was made to fix eg an entrance.

Modified Revenues (AGI)To your All of us tax variations, adjusted revenues is a mathematical number that appears when all of the, earnings sources is subtracted away from every, eligible expenses. Towards the Mode 1040, this matter appears on the internet 37 and you can 38.

AdvanceFor financial aim, an upfront is the perfect place a member of staff becomes their/her wages otherwise income until the time that he usually receives it.

AgentRelating so you can financial things, a real estate agent ‘s the person who serves in the interests of someone, and you will having broad otherwise stipulated, certain battles when becoming others man or woman’s, monetary associate.

Aggressive Growth FundAn Competitive Increases Loans try “aggressive” utilising the economic actions it uses to acquire large investment gains to own a shared funds.

Allotment FormulaTo allocate methods to spread otherwise designate. An allotment formula can be the percentage amount of a dividend in order to spend some for the a specific 12 months, the commission number of income tax so you’re able to designate out-of a withdrawal away from IRA money, etc.

Choice Minimal Taxation (AMT)Getting You.S. tax aim, Solution Lowest Income tax (AMT) is another tax to your specific earnings/expenditures for example expidited decline, depletion, couch potato loss write-offs, an such like.

S. Citizens filing U.S. taxation models can be “hope” to find the Vow Borrowing from the bank. Taxpayers just who attended universities in the freshman and you will sophomore many years within least into a member-time base, and had unreimbursed, eligible, education-associated expenditures can usually claim that it borrowing from the bank.

AmortizationFor financial purposes, amortization ways to repay periodically particular items that can seem into tax returns. A couple preferred instances is actually home financing and you can bonds’ premiums.

Yearly Fulfilling of ShareholdersShareholders keeps “shares” (financial focus) into the a great businesses or organization’s really worth. An annual fulfilling out-of investors happen just after annually where every shareholders may sit-in into the-individual.