Greatest A real income Local minimum £5 deposit casino casino Programs 2024: Better Cellular Casinos online

5 octubre, 2024Best 33 disco night fright $1 deposit Mobile Gambling enterprises Uk Rating £10 Cellular No-deposit Bonus

5 octubre, 2024A home guarantee financing is a predetermined-rates, second home loan which allows one to borrow secured on the fresh security within the your house. That it payment financing gives you accessibility fund for almost any mission, plus merging large-attention personal debt , buying large expenditures and you can layer issues .

If you’re considering experiencing the residence’s guarantee, there are a great amount of federal and local banks, borrowing unions an internet-based lenders giving household security financing. Because you might assume, loan possibilities and you will financing standards cover anything from financial so you’re able to lender. We now have authored this guide to choose mate lenders providing a knowledgeable house equity finance around the various classes.

Ideal complete: Look for

When you get conserve thousands of dollars throughout the years because of the going for property security mortgage to your low apr (APR), other variables are also necessary to imagine. It makes sense so you’re able to equilibrium borrowing limitations, fees terms, costs or any other factors to generate an informed choice that most useful provides your needs.

In this way, Find is actually the selection for a knowledgeable total home collateral financing you to monitors all packets, instance:

- Aggressive prices: Repaired price .

- Large guarantee availableness: While most lenders enables you to access as much as 80% to help you 85% regarding good house’s really worth, Discover’s home guarantee fund render an optimum 90% loan-to-value (LTV) rate in the event the qualified.

- Higher borrowing limit: Household guarantee financing limits range from $thirty five,000 in order to $300,000.

- Flexible payment choice: Financing repayment words was having ten, fifteen, 20 otherwise thirty years. Reduced installment words basically produce higher monthly installments, but you will save a great deal more inside interest across the life of the new financing. However, expanded conditions bring about all the way down monthly payments, but you will spend a whole lot more within the desire full.

- No origination costs: Get a hold of plus cannot charges appraisal charges, home loan taxation or require bucks at closure.

Ideal for reduced Apr: Third Government

As of , 3rd Government has the benefit of family security funds which have costs regarding 7.29% in order to seven.59% for five- and you may 10-season house collateral loans, correspondingly. The lending company offers a lower Rates Guarantee that says, “3rd Government will provide you with a decreased interest into a comparable Home Collateral Financing (HELOAN) given https://elitecashadvance.com/installment-loans-wi/montreal/ by any properly licensed bank, or shell out you $step one,000.” Mortgage wide variety start around $10,000 so you can $two hundred,000 with a max LTV regarding 80%.

In the event you live-in Florida otherwise Ohio, you are entitled to Third Federal’s Fixer Higher Household Repair financing. This method is perfect for people shopping for a tiny dollars infusion ranging from $1,000 and $9,900 to own property recovery investment.

Perfect for do it yourself: Flagstar

Flagstar is one of the biggest home loan originators from the Us. Brand new lender’s house security funds can be ideal for people with upper-really worth house and you may reasonable guarantee they can access to shelter renovations.

If or not we would like to use house equity while making fixes or build additional place, Flagstar Bank’s domestic guarantee loan also provides borrowing wide variety which will match the bill. Specifically, financing numbers range between $ten,000 so you can $1,000,000 having payment terms of ten, 15 or 20 years. Regrettably, Flagstar does not provide family equity finance in any condition, therefore get in touch with the lending company to test to have loan access on your own area.

Good for debt consolidating: Rocket Financial

Of many Americans try carrying large volumes out-of consumer debt. According to Experian, overall consumer debt balances risen up to $ trillion during the 2022, right up nearly $step one trillion over the past year.

It is recommended you merely explore domestic guarantee funds to address problems instance unforeseen medical expenses and you can disaster debt consolidation. However,, in the event that option selection are not available, property collateral financing or HELOC may relieve your allowance in the event the you might consolidate high-interest loans for the you to lower-interest financing. Consider taking a house guarantee financing price out-of Skyrocket Mortgage so you can see if a different sort of mortgage you certainly will decrease the strain on your funds and probably save some costs in the appeal fees.

Skyrocket Mortgage are an established home loan financial giving household equity fund anywhere between $forty-five,000 so you’re able to $350,000 and you will cost regards to ten and you will two decades. Cost differ based on your own borrowing, guarantee and other activities.

In order to meet the requirements, you will need at least FICO credit rating out of 680, and your loans-to-earnings ratio have to be forty five% or less.

U.S. Financial offers home collateral fund so you’re able to borrowers having credit scores away from 660 or even more and you can whom satisfy qualifications requirements. However, a top credit score can help you be eligible for a lot more positive terminology. U.S. Financial is the greatest domestic equity financial to possess consumers which have advanced level credit because of its reduced Apr also provides to have consumers with borrowing an incredible number of at least 730.

Since , You.S. Bank even offers 8.40% Apr towards the an excellent ten-12 months label to possess property equity financing . The pace pertains to fund anywhere between $50,000 so you’re able to $99,999 up to sixty% LTV. To get a reduced price, you really must have a credit score of at least 730 and arranged automatic payments off a U.S. Financial personal checking otherwise family savings.

Best for individuals that have bad credit: Come across

Our a number of a knowledgeable domestic guarantee financing finishes in which they first started. Come across took home an informed total house collateral financing prize because it excels in various groups, including that one.

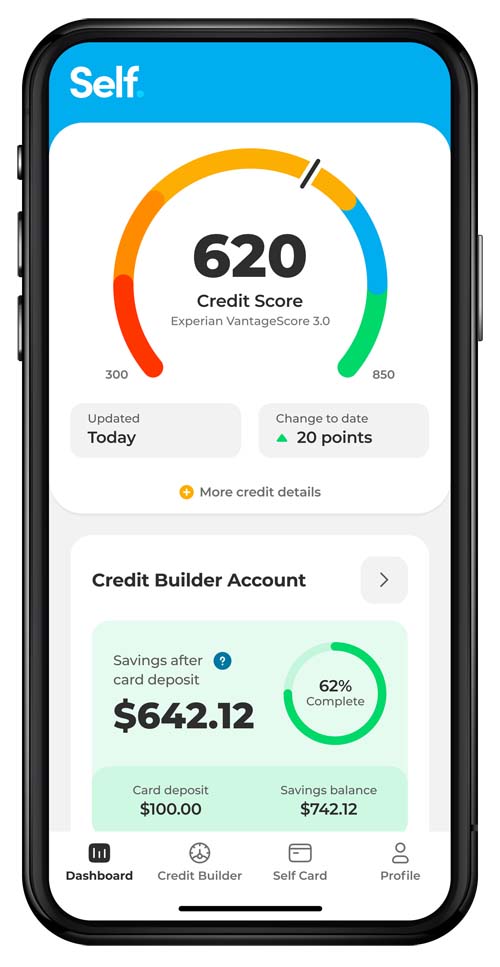

That have a minimum credit score element 620, Discover’s family guarantee mortgage facilitate consumers who’s got restricted possibilities on account of poor credit. Like other loan providers, Find together with takes into account credit rating, a career, income, guarantee count and other issues when evaluating household equity applications.

Obviously, high credit scores perform unlock your to alot more beneficial terms and conditions, eg credit constraints more than 80% LTV. Get a hold of together with cards financing needs over $150,000 wanted a credit score out of 700 otherwise best.

The bottom line

Just as in almost every other lending products, hunting and researching several domestic equity loan lenders makes it possible to narrow your choices and you may choose an educated home equity financing to possess your position. Work with the newest amounts, and interest rates, costs, assessment and cash expected at the closing, to ensure they generate financial sense prior to taking out a different mortgage. Initiate selecting home guarantee loan companies here otherwise through the below table.