There clearly was some other exposure with HELOCs: Your financial might have the capability to lose or frost their credit line

11 septiembre, 2024Disputes and could possibly get occur where an associate has an advice or most other relationship with an unaffiliated lender

11 septiembre, 2024Get a few minutes to discover more on Annual percentage rate, to make certain you’re equipped with every piece of information you should proceed together with your arrangements.

What is an apr?

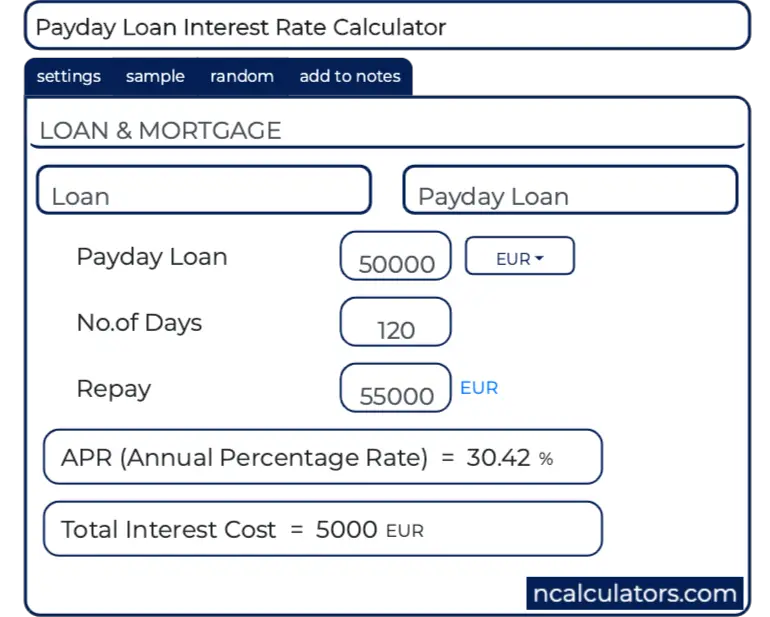

Annual percentage rate otherwise Apr refers to the total price of borrowing to have a-year. Notably, it includes the standard costs and you may focus you’ll have to pay.

Let’s say you obtain ?10,000 over three years to buy a motor vehicle. An annual percentage rate of 5.5% should include your own yearly interest along with basic charges payable on the mortgage. You’d then spend thirty-six monthly payments of approximately ?301, totalling ?10,. This consists of new ?ten,100000 you borrowed and you will ? in the attract and you will charge.

Your instalments are exactly the same every month on account of the way the interest is calculated. In the beginning of the mortgage label, your repayments ought to include much more desire but less of the mortgage balance. Towards the end of mortgage label, your instalments will include quicker attract but more of the financing balance.

What is actually a realtor Apr?

For people who seek a loan, state toward a cost-analysis webpages, the various financing choices are will ranked because of the associate Annual percentage rate.

This new clue is within the word representative’. Whenever a loan is actually reported that have an agent Annual percentage rate, this means you to definitely at least 51% off people located a speed that is the same as, otherwise below, brand new affiliate Apr but not people into the 51% commonly always get the same price.

It could be simple to believe that the lending company toward reasonable affiliate Apr the thing is that said offers an educated price. Yet not, after you apply, you are likely to located an individual e, high, or below the brand new user Annual percentage rate.

See our video for a straightforward review of Apr. This may enable you to see financing prices in more detail before you can use anything.

Very, what exactly is a personal Apr?

After you submit an application for that loan, chances are high the pace you can get depends to your your own personal factors. It will take into consideration your credit report and you may cash, therefore the loan amount and amount of the borrowing from the bank. It’s your personal Annual percentage rate.

You will need to realise this before you apply particularly if you happen to be doing your research based on the affiliate APRs your select said.

The newest member Apr is a good investigations tool, but not necessarily the speed you get. Indeed, its likely that customers gets your own Apr in the event he is on 51% just who discover a rate that’s the identical to, otherwise below, the representative Annual percentage rate.

You may not discover a speed up to once you have applied for a loan, and simply applying can impact your credit rating.

This is because loan providers will always look at your economic records which have a card reference agency before carefully deciding whether to give you a beneficial financing give, plus the inspections would-be registered on your own file. When you take out that loan, the lender should update your credit history.

For individuals who financial with us, we might have the ability to let you know exacltly what the consumer loan rates was beforehand before applying, with no affect your credit rating.

Once you understand yours loan rates before applying installment loans in Blue Springs Mississippi will save you date, that assist you progress together with your agreements.

And then make something simple, for many who bank around, you should check in the event that we could reveal exactly what your personal price is in advance online or in the new Barclays app. And, we might currently have a provisional mortgage maximum able to you personally step 1 . Find out more.