Better $5 Lowest Deposit Casinos on the internet inside Canada upgraded 2025

29 enero, 2025$5 & $10 Minimum Put Local casino Incentives Twice The Bucks

29 enero, 2025Navigating the field of lenders will likely be a daunting task, particularly when your credit score try lower than excellent. While it is true that with the lowest credit history can make it more complicated to safe a mortgage, you can find solutions for you. In this publication, we’ll discuss financing alternatives specifically designed of these having below perfect credit, that delivers a good roadmap towards homeownership.

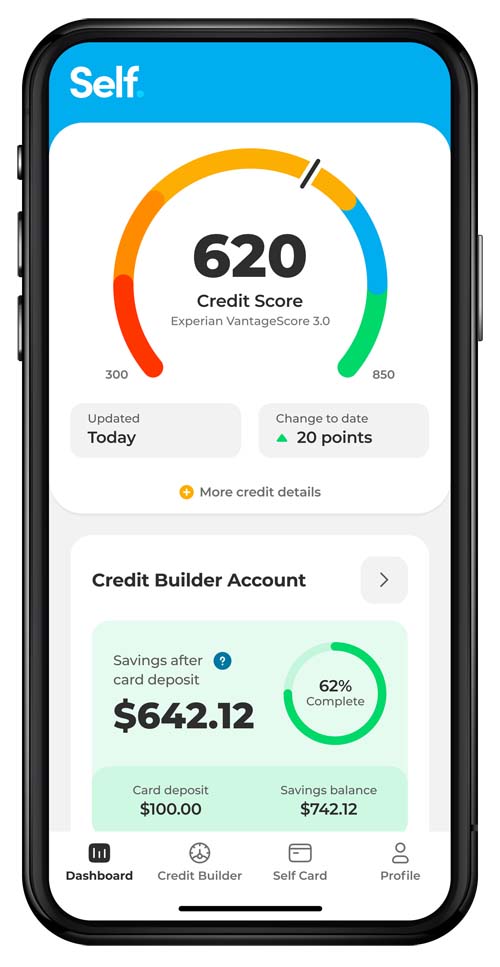

Your credit rating is a beneficial three-digit matter you to loan providers used to evaluate the creditworthiness. It range of three hundred to help you 850 that’s predicated on multiple things, together with your fee records, the amount of financial obligation you may have, in addition to period of your credit score. The better your own rating, the more likely lenders are to approve you having fund at good rates.

- Excellent: 800 and you may significantly more than

- Very good: 740 to 799

- Good: 670 so you’re able to 739

- Fair: 580 so you’re able to 669

- Poor: 579 and you may lower than

If for example the credit score falls to the poor’ group, it may seem such homeownership is out of reach. not, try not to anxiety. There are a means to safer home financing. Why don’t we consider some of them.

step 1. FHA Loans

Government Homes Administration (FHA) funds are authorities-insured mortgages that allow individuals with poor credit score in order to safe a mortgage. Which have a keen FHA loan, you can have a credit rating as little as five-hundred, even though you’ll need to put down about ten% while the a down-payment. If for example the credit rating is 580 or higher, you can even qualify having a down-payment as little as step 3.5%.

FHA finance was common certainly basic-day homebuyers, mainly due to the easy borrowing from the bank conditions and lower down repayments. But not, they are doing require that you pay money for home loan insurance, and therefore increases the total cost of your loan.

step three. USDA Financing

The united states Agencies away from Farming (USDA) now offers loans designed to assist low-to-modest income group buy homes in outlying parts. Eg Virtual assistant finance, USDA financing render 100% capital, meaning it’s not necessary to save getting a deposit.

Just like the USDA will not set the very least credit score criteria, extremely loan providers like a score of at least 640. Remember, not, such loans try geographically and you may income limited you will need to buy a property in a designated outlying town and you can satisfy specific income requirements.

4. Federal national mortgage association HomeReady Financing

The latest HomeReady mortgage system from the Federal national mortgage association is yet another selection for consumers that have less than perfect credit. The program goals lower-to-average earnings borrowers, letting them create a downpayment as little as step 3%. To qualify for good HomeReady financing, you will need a credit history of at least 620.

One novel feature of your own HomeReady system is the fact they takes into account earnings from other family members, regardless of if they’re not consumers into the financing. This may help you qualify if you’re having family otherwise roommates who online payday loan New York state donate to family costs.

5. Non-Certified Home loan (Non-QM) Loan providers

Non-QM loan providers offer funds that don’t meet with the strict qualifications criteria regarding a qualified financial but may getting a viable option for people who have a low credit rating. This type of fund often wanted a more impressive down-payment and you may feature higher rates so you’re able to counterbalance the chance posed by the credit to consumers that have less than perfect credit.

However, they supply independence which have underwriting guidance and certainly will be a good choice for individuals who can’t be eligible for more traditional loan points.

6. Proprietor Financial support

In some cases, new homeowner will be prepared to loans your purchase, effortlessly becoming the lender. This plan, also known as proprietor otherwise vendor financial support, are going to be a viable solution if you’re unable to secure a beneficial antique mortgage because of less than perfect credit.

Having holder financing, you can build money to your merchant more than an assented several months up to you’ve paid down the price and people attention. Understand that conditions can vary greatly depending on the agreement anywhere between both you and the vendor, therefore it is smart to enjoys a bona-fide property attorney comment one contracts before you sign.

While protecting home financing with poor credit is achievable, enhancing your credit history can be start so much more selection and you may possibly best mortgage terminology. Here are some strategies to increase credit rating:

- Pay Your own Expense Timely: Your payment background is the reason 35% of your own credit score, making it brand new unmarried foremost basis. Be sure to pay-all their debts timely in order to seriously impression the rating.

- Lower your Loans: The amount your debt, otherwise your own credit usage ratio, makes up 30% of your own credit rating. Just be sure to lower the money you owe, and avoid maxing out your playing cards to improve which proportion.

- Continue Dated Credit Accounts Unlock: Along your credit report contributes 15% on credit rating. Even although you avoid all of them regularly, keep your eldest credit accounts open to stretch your credit score.

- Limit The fresh Credit Software: Anytime a lender inspections the borrowing from the bank, it does reduce your rating slightly. Restrict your software for brand new borrowing and try to do all the loan looking within this a short period to attenuate the brand new feeling of these questions

Which have a minimal credit history tends to make the road to help you homeownership harder, however it will not allow it to be impossible. Because of the exploring the mortgage choice detailed significantly more than and you can getting procedures to change your credit rating, there are a route to homeownership that fits your needs.

Remember, all the financial predicament is different, and you will what works for starters person may well not work for another type of. It’s always a smart idea to consult an economic advisor otherwise home loan professional understand all of your current alternatives. That have mindful believe together with best means, home ownership would be inside your master, irrespective of your credit score.