Classic Black-jack: The most popular Gambling establishment Online magic forest casino login uk game Informed me

16 diciembre, 2024Play 100 percent free Blackjack On the web browse around this site Now 170+ titles No Install

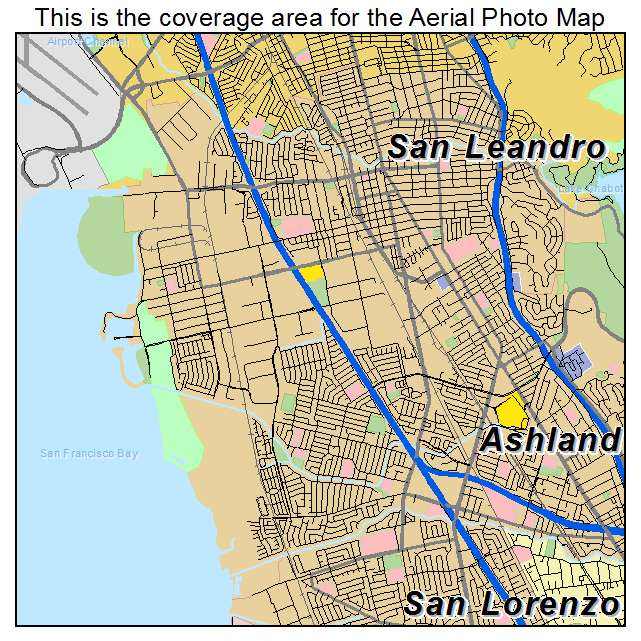

16 diciembre, 2024Take a look at so much more maps:

- SIBOR/SORA Each and every day Rate Graph

- Straight away SORA and Compounded SORA Trend

What is SIBOR?

SIBOR is short for Singapore Inter-bank Considering Rate. It’s the average rates produced from new lending and you will borrowing pricing quoted because of the financial institutions, and you may launched of the Connection of Banks in Singapore (ABS) on regular basis. The brand new prices was wrote once 1 week in the in the morning into Abs web site. SIBOR is generally affected by a couple of affairs, particularly the us Given rates and exchangeability from inside the Singapore financial industry. (Note: SIBOR might be eliminated and you will changed from the SORA of the 2024. Already, financial institutions are not any extended giving funds referencing SIBOR. Present houses finance that will be pegged to SIBOR is keep until particularly big date whenever existing financiers promote most other mortgage packages once the substitute for. )

What is SORA?

The fresh Singapore Right-away Rate Average otherwise SORA is the regularity-adjusted average price out-of borrowing from the bank purchases on the unsecured straight away interbank SGD dollars . So it bench. Just like the , MAS along with posts the latest Compounded SORA for just one-day, 3-month and you may six-day. Newest pricing are available into MAS webpages from the 9am into the second business day.

What is actually step one-Times Compounded SORA?

The new step 1-Day Compounded SORA (1MSORA) try calculated from the compounding this new every day penned SORA rate along side historic 1-times period. For mortgages which might be Indiana loans labelled to one-few days Combined SORA (1MSORA), interest is examined towards monthly basis.

What is step 3-Month Compounded SORA?

The three-Month Combined SORA (3MSORA) are determined of the compounding the latest daily typed SORA price along the historic 3-few days period. To own mortgages that will be pegged to three-week Compounded SORA (3MSORA), interest try reviewed for the step 3-monthly basis.

Differences between SIBOR and you may SORA

Of these familiar with SIBOR, you may question how SORA differs from SIBOR and you can exactly what to anticipate off SORA. An element of the change is the character of your rates in itself. SIBOR hails from give-lookin cost cited because of the banking institutions, whenever you are SORA is the regularity-adjusted average speed based on genuine deals over. SORA is largely a far more credible and transparent standard rate than just SIBOR.

Differences when considering 1MSORA and you may 3MSORA

Regarding the graph, it could be observed one 3MSORA are less volatile than 1MSORA. This really is mainly due to the latest smoothening feeling more than a lengthier period to own 3MSORA which songs this new every single day SORA getting prior ninety days versus 1MSORA and that music the fresh each and every day SORA having just earlier in the day 1 month. Whenever SORA are popular upwards, there’s a propensity getting 1MSORA getting higher than 3MSORA due to rising SORA costs in earlier times thirty day period. At the same time, 1MSORA tends to be lower than 3MSORA whenever SORA is actually trending off.

Mortgages which can be referencing 1MSORA is analyzed towards the month-to-month basis when you’re men and women labelled so you’re able to 3MSORA are assessed towards step 3-month-to-month foundation.

When SORA is actually popular up, if your housing loan try labelled to help you 1MSORA, there is certainly your own construction financing speed upgrading earlier because as compared to home loan pegged to 3MSORA. Simultaneously, when SORA is popular downwards, you are going to spend down hobbies before as compared with loans labelled so you’re able to 3MSORA.

Houses financing that is labelled so you’re able to 3MSORA are perceived as more stable in line with 1MSORA as the banking companies just remark the eye rate all the 90 days, otherwise 4 times a year. When SORA is trending up, when your construction financing is pegged to 3MSORA, you will see the brand new changed higher level simply next remark. On top of that, whenever SORA is popular off, the brand new coupons inside appeal is likewise postponed.

We know what truly matters very to you. Call us today to get going. Discover more: Our Services | Why You? | Exactly what our Readers state