3 Möglichkeiten: Entsprechend entsperren Diese unser Tastatur within Windows 10 11? MiniTool

14 noviembre, 2024Einfarbig Probiere nicht mehr da

14 noviembre, 2024- The ability to refinance into a predetermined-speed mortgage if the mortgage rates drop

As mentioned more than, really home buyers choose decide for a fixed-rates financing in which their monthly installments is certain to continue to be the newest same regarding lifetime of the mortgage. Interest-merely loan money do not defense dominant – for this reason they trust family rates appreciation to create equity. If your housing marketplace drops, IO money can simply finish upside down. Balloon mortgages are required to be refinanced otherwise paid which have a lump sum to your a-flat day.

Opting for Between them Financial Types

Fixed-rates money enjoys a reliable price in the longevity of the latest financial (this is exactly why they’ve been titled repaired). The fresh new Annual percentage rate for the a varying-rates mortgage can transform (and that the term changeable), therefore constantly do therefore merely after a predetermined number of age, such as for example step three, 5, eight, or ten. After that part, the latest Annual percentage rate changes just after per year, or possibly more often.

Hands normally have speed hats, and so the annual percentage rate will not change too dramatically inside a primary length of time. So just why do you really wish to have financing with an enthusiastic focus that may transform? Given that first price, which is fixed, often is less than the brand new Apr into a predetermined-price mortgage.

The lender could possibly counsel you on which form of regarding home loan to determine. not, it is completely your choice to choose and therefore home loan sorts of caters to your role and you can existence best. Nowadays, most individuals is looking at fixed-rate mortgage loans as mortgage costs is extremely low of the historical criteria. These straight down costs make it easier to compete with the lower very first payments brand new Case even offers, which is the major reason anybody selected Sleeve first off. If you reside in a premier-costs area of the country, you’d generally speaking you would like a more impressive downpayment with an adjustable-rates home loan, and this refers to also driving anybody on the fixed-price mortgage loans.

Borrower Criteria

No matter what version of mortgage you get going for, there are particular conditions levels you’ll have to fulfill before good financial considers one to qualify.

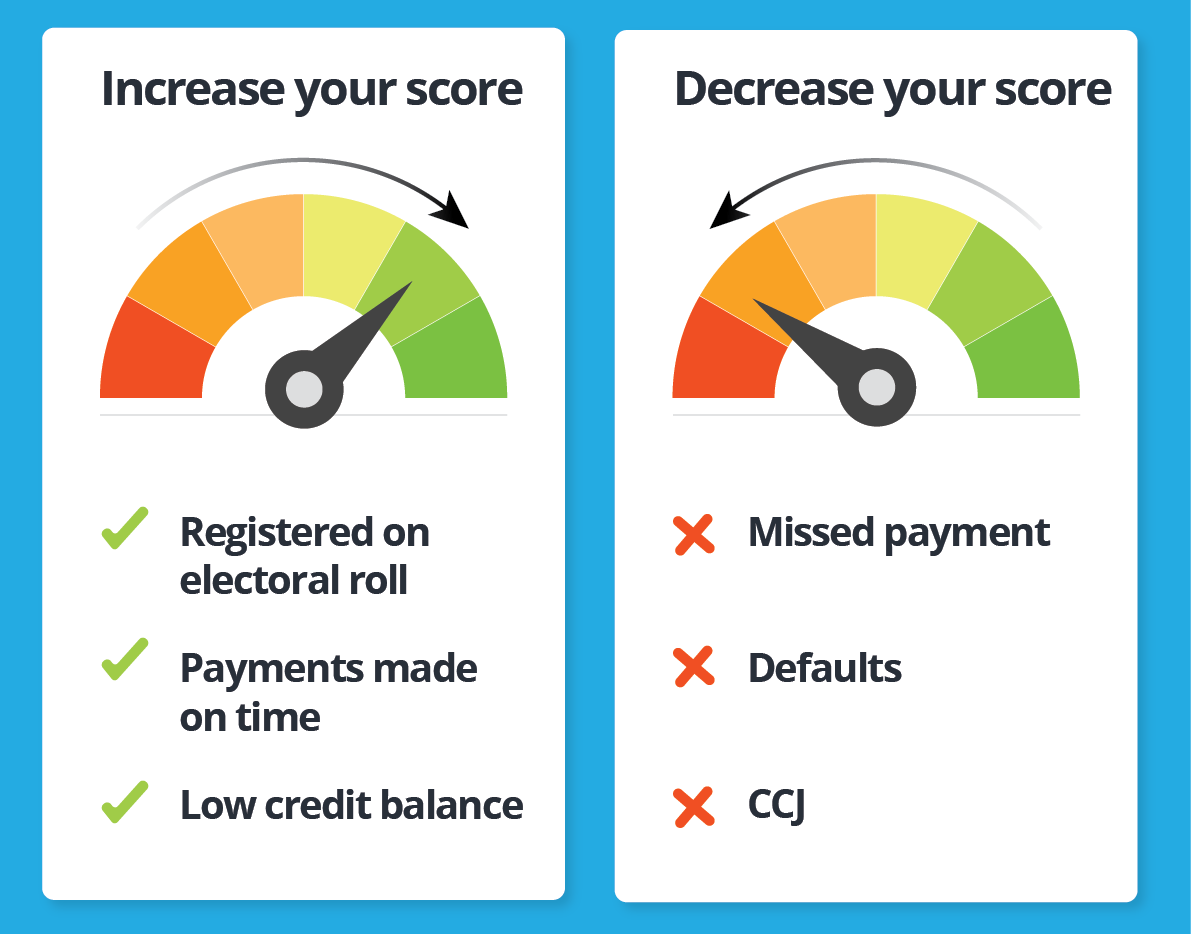

- Credit rating. Lenders want to see credit scores regarding the mid to help you upper 700s. Yet not, you’ll get home financing having a credit history out of 620, however you will spend a higher downpayment.

- Debt-to-Income. Their monthly debt is essentially just about thirty-six% of disgusting month-to-month income. You might go up to 49% which have a stellar credit score and you may rating.

- Deposit. Unless you get a lot more resource or you use a course one to will pay your deposit, its a good idea to has about ten%, and preferably 20% of your own residence’s cost put away having a deposit.

- A job Records. Their financial would like to see a stable a career history having on minimum a couple of years at the current employment.

- Mortgage to help you Well worth Proportion. The loan so you’re able to value ratio is how far the house was worthy of resistant to the amount you are borrowing. If at all possible, your loan so you can well worth proportion will be 80% otherwise straight down.

More Considerations

As well as everything we in the above list, you will find several a lot more factors you have to contemplate when you apply for a home loan, long lasting type of it is.

Acquiring Personal Financial Insurance rates first site (PMI)

Private mortgage insurance is something that you might have to possess when you take your real estate loan. PMI protects the financial any time you end using on your financing or standard found on they. You’ll be able to normally have to spend PMI for folks who spend lower than 20% down when you take your own home loan away. About 35% out of home buyers was play with a downpayment away from 20% or maybe more.