9 Masks from Fire Slot Enjoy & Bonus

24 octubre, 2024Earn to 10,five-hundred Credit

24 octubre, 2024Similar to being qualified to have a traditional home loan, fulfilling lender requirements as much as credit score, lowest down costs, and you can loans-to-money ratios are important portion to own protecting investment for a manufactured household.

This includes having a good credit history, generally more than 640, showing your ability to cope with obligations sensibly. While doing so, having the ability to provide a downpayment, always around 5% to 20% of one’s house’s purchase price, shows your own dedication to the latest capital. Maintaining a healthy and balanced obligations-to-earnings proportion, essentially below 43%, implies that you could potentially easily pay the monthly installments on your own manufactured mortgage.

Also your financial standing, there are certain a few when purchasing a mobile home that have financial support, such as the ages of your house. Essentially, mobile home lenders wanted house is constructed before 1976 so you can qualify for resource, and lots of could even wanted new land.

From the appointment these types of earliest requirements, you improve odds of recognition and you will reputation yourself due to the fact a legitimate debtor in the sight from lenders. Second, let’s dig to the all of theses elements in more detail.

Questions regarding Qualifying getting a produced Family? Chat to the Pro Lenders.

Because of the emphasizing these credit rating affairs, you could potentially replace your probability of qualifying to possess a cellular house financing, and also make your ultimate goal out of buying a manufactured home even more doable.

- Pay the bills promptly: Later costs can also be rather spoil your credit rating. Starting automatic payments may help stop so it.

- Remove Financial obligation: Reduce your credit usage ratio if you are paying down mastercard balance or any other costs, that may undoubtedly affect the score.

- Prevent The Borrowing from the bank Inquiries: For every single tough inquiry can also be slightly reduce your rating. Get the fresh credit only when called for.

- Frequently Display screen The Borrowing from the bank: Look at the credit file a year 100% free off each one of the around three major credit reporting agencies. Disagreement any inaccuracies you notice.

- Broaden Your Credit: A combination of borrowing from the bank versions (credit cards, automobile financing, an such like.) is undoubtedly effect your rating, demonstrating you could deal with all sorts of borrowing from the bank sensibly.

The greater your own down payment on a produced household, the greater favorable your loan terminology have been around in the fresh new much time work at. Listed here are a few examples describing how measurements of their off payment make a difference to their monthly are produced financial commission.

For-instance, let’s consider a situation the spot where the are manufactured house you’re looking so you can get will set you back $forty,000, and you can you entitled to an interest rate off eight.00% towards a beneficial eight-year loan.

- A loans Wetumpka down payment of five% would-be $dos,000, definition the loan number would be $38,000. Your payment was about $573.

- A deposit off 20% could be $8,000, definition the loan number will be thirty two,000. The monthly payment might possibly be throughout the $482.

The better deposit results in a good $91 month-to-month savings (more $step 1,000 a-year). When making use of a tight budget, this may features a serious affect your finances regarding the duration of the loan.

The necessity of Your debt-to-Money Proportion to have a manufactured Financial

Proper loans-to-income (DTI) proportion is key getting loan eligibility, it ratio suggests lenders simply how much of earnings goes towards loans repayments. Less ratio means the debt is actually in check to you personally, prior to income, so it’s apt to be you really can afford their are formulated financial payments. Usually loan providers discover a proportion out-of forty-five% or less to demonstrate debt balance, not a ratio lower than 36% is recommended.

The debt-to-earnings proportion is straightforward to estimate, simply add up the month-to-month debt burden (automotive loans, mastercard payments, rent/mortgage, or any other debts). Upcoming split you to count by the pre-income tax month-to-month money. Here’s brief example:

Can you imagine you may have an auto loan payment off $250, rent regarding $step one,five-hundred, and you can credit cards totaling $150 every month. You to definitely results in $step one,900 during the monthly premiums. Which have a good pre-taxation earnings out-of $cuatro,000 per month, the debt-to-earnings ratio was 47% ($step one,900 separated by $cuatro,000) . In this circumstance, you might have to think paying down certain debt otherwise seeking an effective way to enhance your money to meet up what’s needed getting a are designed mortgage.

What is the Earliest Are created House which is often Funded?

The question out-of resource older are made home will puzzles people, while the loan providers normally have strict criteria regarding the years and you may position of the house. Basically, this new earliest are manufactured home that can be financed is certainly one founded immediately after June 15, 1976. This day is extremely important because marks the fresh implementation of the new HUD (You.S. Agency off Casing and you may Urban Advancement) standards into the build and you can safety from are formulated house.

Homes depending before this go out was impractical in order to satisfy most recent capital standards because of these types of stricter standards. Although not, of a lot loan providers provides direction one next reduce age a beneficial are built home to below 40 years dated.

Of course, you can find exceptions and various affairs that dictate a created domestic lender’s decision in regards to the age of a cellular household you’re offered. Including, a highly-managed are created household who may have experienced extreme upgrades or improvements may feel an exception, considering they seats an extensive assessment and assessment techniques.

If you are searching at earlier are available property, it is critical to browse and you may potentially identify lenders which have sense inside market housing marketplace, such Basic Alliance Borrowing Relationship. Knowing the requirement for the newest June fifteen, 1976, cutoff and getting ready to reveal the value and defense away from an earlier domestic are fundamental steps in protecting financing to own a manufactured home.

Simple tips to Ready yourself to apply for a made Mortgage

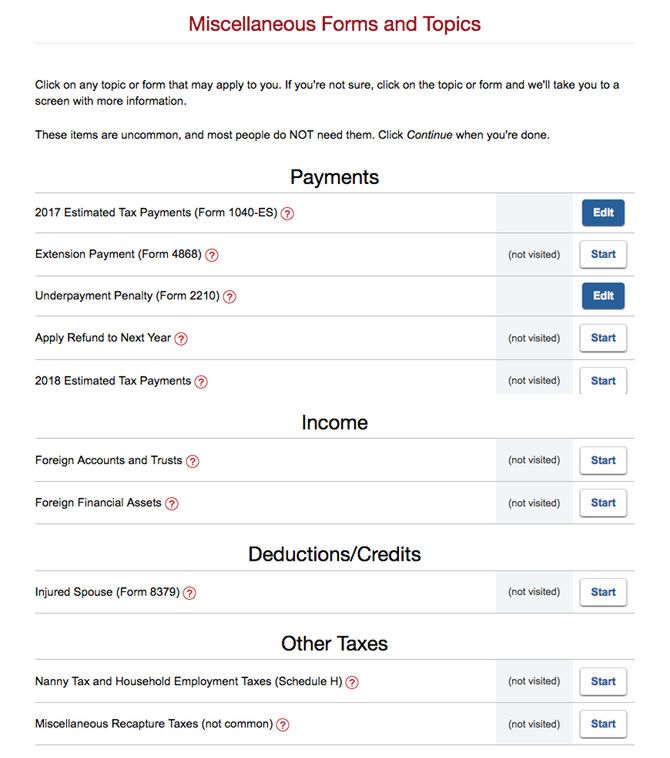

If your credit history, advance payment, and loans in order to money percentages search advantageous, then your step two is to get able into the cellular home loan application process.

Before you apply to have a cellular mortgage, it’s important to has an obvious knowledge of the new payment count that actually works best for you. Take care to manage a resources filled with all of the costs associated with purchasing a made household, for example tools, parcel book, installation expenditures, maintenance charges, and a lot more.

Additionally, you will have to assemble very important records prior to your implement, such as for instance pay stubs, authorities personality, and you can proof their advance payment. Having this information along with you after you implement will help improve the application to get to your new home ultimately.

Exactly how Basic Alliance Credit Relationship Can help you having Are manufactured Household Funds

First Alliance Credit Partnership offers designed loan choices for investment are manufactured belongings, with competitive costs and you can individualized options. All of our experienced staff brings specialist information, one-on-you to meetings, and full service in order to navigate the credit process.

Since a residential district-concentrated borrowing from the bank commitment, we encourage our players to reach its homeownership needs with formal loan services customized advice.