Should i Fool around with an unsecured loan to own Do-it-yourself?

23 octubre, 2024Mobile No deposit Incentives, 50+ Best Local casino Internet sites 2024

23 octubre, 2024Individual Upwards Employees

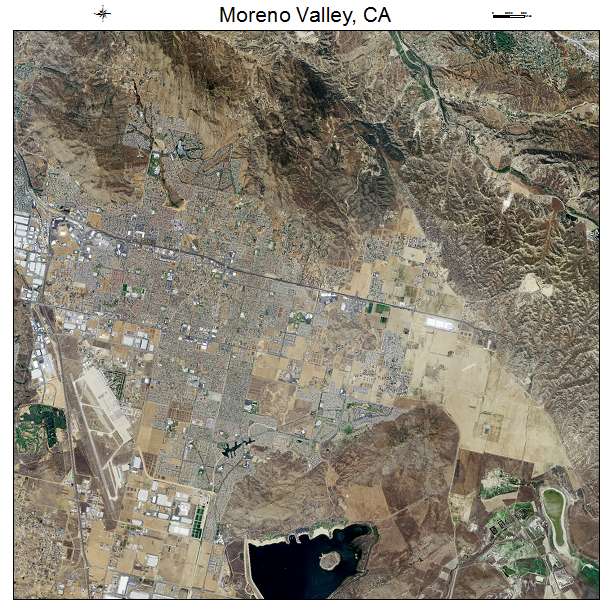

Hytop pay day loan alternatives

Very own Upwards try a myself held, Boston-based fintech startup which is towards an objective to be certain every family consumer get a fair offer to their mortgage because of the for any reason strengthening people who have customized study, custom pointers, and you will unmatched use of lenders to help make ideal financial effects and you can clarify our home financing sense.

Property is considered the most costly get a lot of people makes within lifestyle, very finding considerably is key. Roughly one in four home buyers are an experienced otherwise active-responsibility provider member with respect to the Federal Organization away from Real estate agents, and these buyers will most likely imagine good Virtual assistant home loan. In fact, 77% regarding active-duty army and 58% out of Pros put a Virtual assistant financial to get their residence.

Veterans, active-duty services players, specific National Shield and Solution professionals, and you can enduring partners of some pros be eligible for Virtual assistant home loans. For these funds, this new Virtual assistant try possibly the lender (in the case of lead home loans) or pledges a mortgage of an exclusive financial (in the example of Virtual assistant-recognized mortgage brokers).

Particular Va Finance

- Virtual assistant direct financial: The fresh new Local Western Head Financing Program (NADL) brings financing to Indigenous American pros otherwise pros and their partners. These financing allow you to buy, create otherwise increase property with the federal trust residential property.

- VA-supported purchase mortgage: Such money are given of the a personal financial but supported by the fresh Virtual assistant and require zero deposit that can features ideal terminology and you can rates than just private funds.

- Interest Protection Home mortgage refinance loan (IRRRL): This type of fund promote good refinancing selection for current Virtual assistant-supported finance.

- Cash-out refinance loan: That it loan allows individuals when deciding to take dollars-away having home guarantee or re-finance a non-VA-recognized mortgage toward an excellent Virtual assistant-recognized mortgage.

Financing Terms

Virtual assistant funds are mainly distinct from fund off private lenders due to the fact nearly 90% of them require no downpayment otherwise financial insurance coverage. The only situation where a down payment is required occurs when the sales price is higher than the newest appraised well worth. Getting a classic loan out of a private bank, the new down-payment is actually 20% of your price otherwise private mortgage insurance (PMI) is needed.

Va Loan Financing Payment

Virtual assistant financing require an effective Va resource payment, hence commission ‘s the biggest costs amongst all the closing charges for a beneficial Virtual assistant financing. Closing costs to own Va money are typically 2% so you can 5% of your buy prices. Except for new financing percentage, and is rolling into the mortgage, all other closing costs must be repaid in the closing.

The new Va funding commission offsets the expense of the fresh VA’s financing make sure system and you will charge confidence the cost and kind away from loan are funded. For people who located Virtual assistant impairment compensation otherwise may be the enduring partner regarding an experienced who gotten disability payment, you may be excused away from make payment on resource fee. Individuals can choose to help you both spend the money for complete commission in the closing with other closing costs or funds the fee included in the borrowed funds.

The latest financial support percentage applies to the borrowed funds count, maybe not the cost of the home. To have a beneficial $3 hundred,000 family (The average Virtual assistant amount borrowed getting Quarter 3 off 2021 was $309, 816), brand new financing payment in numerous scenarios is below:

- An advance payment off 10% to own either an initial-date or repeat Va debtor:

- An advance payment of five% for both a primary-big date or repeat Va borrower:

- No advance payment to possess an initial-time buyer: $300,000 x 2.3% = $six,900